The world is witnessing a significant shift in global economic power dynamics. The BRICS group, comprising some of the largest emerging economies, has been pushing for de-dollarization – reducing reliance on the US dollar for trade and investment. This move has raised questions about the future of global trade and economic stability.

Who Are the BRICS Nations, and Why Are They Important?

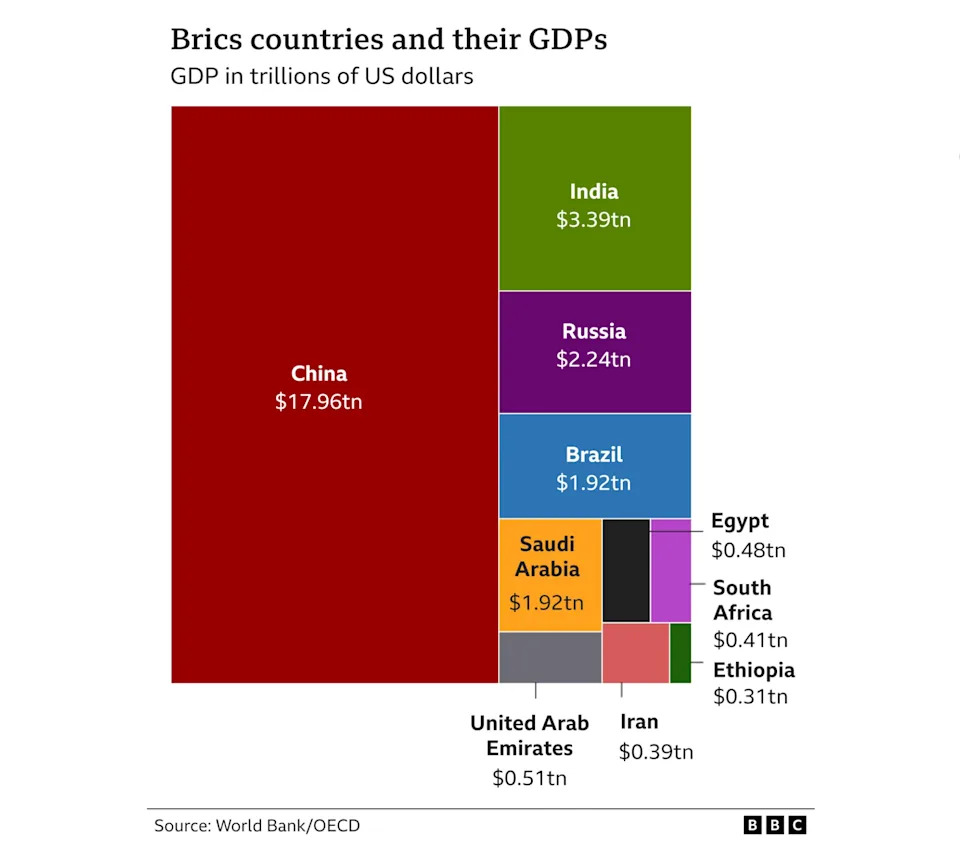

The BRICS group represents 11 countries that collectively account for nearly 28% of global GDP and 44% of the world’s crude oil production. The bloc now includes new members such as Iran, the UAE, and Ethiopia. With a combined population of over 3.5 billion people – about 45% of the global population – BRICS is an economic powerhouse.

Initially formed to counterbalance Western powers’ economic dominance, BRICS has grown into a platform for challenging global financial norms. Key members like China and Russia have taken the lead in advocating for an alternative global reserve currency, citing the dollar’s "weaponization" by the US.

What Is De-Dollarization, and Why Are Some BRICS Nations Pushing for It?

De-dollarization refers to reducing the global reliance on the US dollar. The dollar’s status as the world’s primary reserve currency gives the US significant geopolitical leverage, allowing it to impose sanctions and influence financial markets.

Countries like Russia and China argue that this power undermines their sovereignty and have sought alternatives. At the 2023 BRICS summit, the group explored the possibility of a shared currency to facilitate trade and bypass the dollar-dominated system.

Trump’s Tariff Threats: A Negotiation Tactic or a Precedent?

The US has been vocal in its opposition to de-dollarization, with President Trump imposing tariffs on several countries. However, some analysts suggest that these threats may be part of Trump’s negotiating playbook rather than a genuine attempt to escalate tensions.

Are We Heading Toward a Trade War?

The clash between the US and BRICS nations highlights broader tensions in global trade and finance. While the likelihood of BRICS fully abandoning the dollar remains low, their gradual shift toward de-dollarization signals that the world may be entering a new era of economic competition.

A global trade war could have far-reaching consequences, destabilizing markets, increasing costs, and slowing economic growth. The stakes are high for both the US and BRICS nations, with each side determined to maintain its economic dominance.

Conclusion

The BRICS challenge to the dollar-dominated system is a significant development in global economics. While de-dollarization remains an ambitious goal, the group’s efforts highlight growing dissatisfaction with the current system. The consequences of a trade war between the US and BRICS nations are uncertain but could have far-reaching implications for the global economy.

Disclaimer

CFDs are complex instruments that come with a high risk of losing money rapidly due to leverage. Between 66% and 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades Corp is authorised and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (‘AT’). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Related Articles

- Gold: Safe-Haven Demand Boosts Prices Ahead of PMI Data

- Rising Sales Have DoorDash Delivering Gains

- BRICS, De-Dollarization, and the US Trade War: What’s at Stake?

- Trump’s Actions Could Derail the Fed’s Rate-Cutting Strategy

- Earnings in Focus: How Lowe’s, Target, and Nvidia Navigated Q3 Challenges

Note: This article is based on publicly available information and is for general informational purposes only. It should not be considered as investment advice or a solicitation to buy or sell any financial instrument.